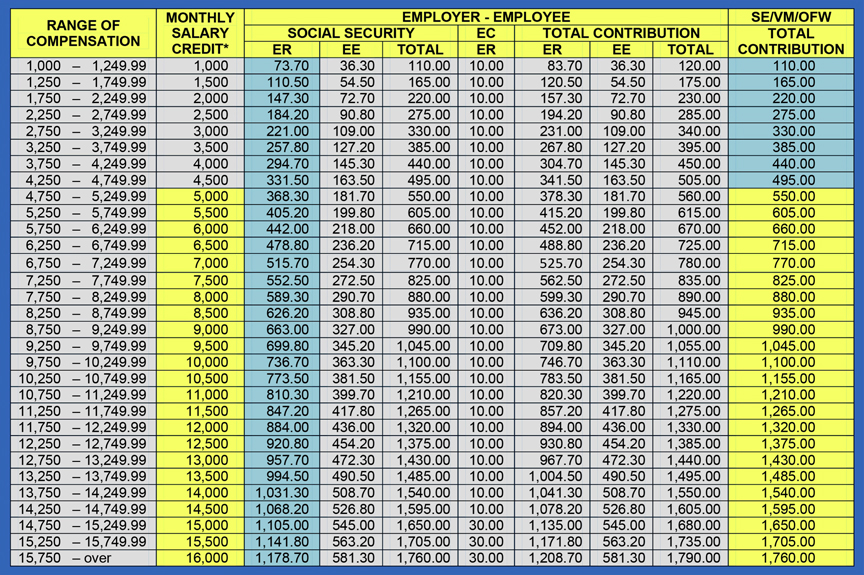

Social Security 2025 Max Withholding Table. Employers must withhold the 0.9% tax when compensation of an employee exceeds $200,000, regardless of filing status. There is no comparable tax on employers.

In 2025, individual taxable earnings up to $176,100 will be subject to social security tax, according to an announcement by the social security administration (ssa) on thursday. 11 rows if you are working, there is a limit on the amount of your earnings that is taxable by social security.

2025 Max Social Security Tax By Year By Year Brandon Gill, The maximum amount of earnings subject to social security tax (taxable maximum) will increase to $176,100 from $168,600.

Social Security Withholding 2025 Maximum Age Katha Maurene, Both of these amounts are adjusted annually for inflation.

Social Security Tax Limit 2025 Withholding Amount Chloe Paterson, For 2025, the fica tax rate for employers will be 7.65%.

Social Security 2025 Withholding Sebastian Howard, Both of these amounts are adjusted annually for inflation.

Max Social Security Tax 2025 Withholding Calculator Phebe Brittani, In 2025, individual taxable earnings up to $176,100 will be subject to social security tax, according to an announcement by the social security administration (ssa) on thursday.

Social Security 2025 Max Withholding Table Ciel Alberta, This is the first time any retiree will take home more than $5,000 per month from the program.

Social Security 2025 Max Withholding Table Ciel Alberta, To know if you exceed the limit, check your overall earnings.

Social Security 2025 Max Withholding Sue Lettie, The social security tax limit will increase by about 4.4% in 2025.

Social Security 2025 Max Withholding Meaning Lucia Shannah, At the 6.2% rate, the maximum payroll would withhold from each employee’s wages for social security tax would reach $10,843.80.

Social Security 2025 Max Withholding Declaration Myrle Tootsie, This is the first time any retiree will take home more than $5,000 per month from the program.